Contents:

Unlike Motive waves, Corrective waves sub-divide into three sub-waves, with the primary objective or correcting the Motive waves. Corrective waves are labelled using letters rather than numbers to distinguish the three different types of corrective wave structures. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. Apart from the investor sentiments, the Elliott Wave Theory also accounts for the effects of outside influences. Also we can see that wave to completed one bigger impulse which is market as wave and wave ,, completed one bigger corrective wave .

Belarusian Opposition Blogger Klimovich Dies In Prison, Says Rights Group – Radio Free Europe / Radio Liberty

Belarusian Opposition Blogger Klimovich Dies In Prison, Says Rights Group.

Posted: Sun, 07 May 2023 16:35:02 GMT [source]

The impulse wave is the most prevalent kind of motive wave in a market, and it is also the wave that is simplest to identify. The Zig-Zag Wave, the Diagonal Wave, and the Triangle Wave are the three most common forms of corrective waves. No you cant use data from your trading terminal to feed motive wave software.

For example, if you are an intraday trader, you can use one minute, five minute or hourly candles. The Elliott Wave Theory, through its deep analysis of past data, empowers investors to spot a precise price point where the market is probably going to reverse. This price point helps identify the ideal entry and exit point. It also allows them to adjust their portfolio to realise gains or mitigate losses. The theory holds as these are recurring patterns, the movements of the stock prices can be easily predicted.

Is Bank Nifty Forming An Ending Diagonal?

The market’s movement is the primary objective of a motive wave, and impulse waves are the ones that are most effective in achieving this aim. The Elliott wave theory is a type of analysis tool that aids traders in understanding the cycles of the financial markets. The Elliott Wave theory is a type of technical analysis that searches for recurring long-term price patterns connected to enduring shifts in investor’s sentiment. Continue reading as we discuss the types of waves in this theory.

- The Zig-Zag is a corrective wave that consists of three waves that are labelled as A, B, and C and that move sharply in either the up or down direction.

- In the event that any of these guidelines are broken, the impulse wave is not produced, and we will need to re-label the wave that we first thought was an impulse.

- The theory works to ascertain the direction of market prices through impulse wave and corrective wave patterns study.

- The motive waves or the impulse waves from the dominant waves in the downward direction while the corrective waves are in the upward direction.

- Moreover, this wave theory can also be used along with additional Technical Analysis to find out possible opportunities.

Fibonacci retracements are drawn in the price charts to determine support and resistance levels. Effectively determining the support and the resistance levels is essential in making a profit from the market. The third wave must always be greater than either the first wave or the fifth wave.

motive wave software [ nse and bse real time chart ]

Also, the sub-waves of the diagonal may not have a count of five, depending on what type of diagonal is being observed. However, the Elliott Wave should not be considered as a technical indicator but a theory that helps in predicting the behaviour of the market. Wave 5 is typically inverse 1.236 – 1.618% of wave 4, equal to wave 1 or 61.8% of wave 1+3′. This corrective pattern demonstrates a balance of forces, and it moves in a lateral direction.

The theory identifies impulse waves that set up a pattern and corrective waves that oppose the larger trend. This is the best way of follow-up course for Technical Analysis. This course deals with the major Fibonacci patterns, using various technical tools with emphasis on Elliott wave & Gann Techniques. Later, this theory acquired adoption in the community of investors. Moreover, this wave theory can also be used along with additional Technical Analysis to find out possible opportunities. The theory works to ascertain the direction of market prices through impulse wave and corrective wave patterns study.

In bullish trends, the wave pattern is 5 waves up and 3 waves down. Fibonacci analysis is the study of identifying potential support and resistance levels in the future based on past price trends and reversals. Fibonacci analysis is based on the mathematical discoveries of Leonardo Pisano-also known as Fibonacci.

However, the Elliott Wave Theory is just a way to help investors order the possibility of future price action. We shall consider upward direction as the direction of main trend and downward direction as the direction of corrective wave in our discussion. But opposite of this is equally possible and all rules can be similarly applied.

My Experience with this software is really awesome and user friendly with less jargons . Iam also to configure my Ichimoku trading system even 5-13 EMA channel trading system and also still need to explore a lot in this software package. It does, however, give a substantial amount of clarity to the art of trend spotting. Elliott’s original principles may be made as complicated as a trader wants, but it is unquestionably an approach that many traders choose to prioritise in their market tactics. A truncated fifth wave does not move beyond the end of the third.

Furthermore, motive wave waves comprise five different sub-waves that make net movement in a similar direction as the trend for the upcoming large degree. With the help of this Elliott wave theory, traders can forecast market trends by identifying extremes in prices and investor psychology. During an uptrend of the impulse wave, the buy positions are at the support levels of the second and fourth waves. Conversely, traders can sell or short the position when the five-wave pattern is completed as the reversal is definite. Traders could be described as riding the wave to profit from the fluctuations from the capital market which forms the basis for the Elliot Wave theory. The investors’ psychology or sentiment plays a huge role in this theory.

However, it is advised that you use the theory along with other technical indicators to mitigate any false signals. The motive waves may have a chance of being extended over the original period. This means that the three waves can last longer than the remaining two reactionary waves. However, the extension of the time frame entirely depends on the market sentiment and psychology. The Elliott wave principle is a form of technical analysis that helps traders in analyzing financial market cycles.

In fact, it is almost always to be labeled as shown in Figure 1-8, implying an extended wave in the making. Do not hesitate to get into the habit of labeling the early stages of a third wave extension. NSE The National Stock Exchange is one of the largest and most advanced stock exchanges in the world. Simply register for an account, download and install the software. All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data.

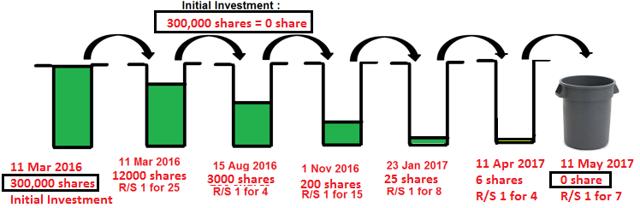

Thus a whole corrective wave completed from to .This is how a wave cycle is completed. Wave , and consist of inner/lower degree wave i,ii,iii,iv,v and wave and consists of inner wave a,b,c. Every wave consists of a set of smaller/inner waves; in other words we can say every smaller wave combine to create a bigger wave.

ELLIOTT WAVE

Thank you very much sir for share this software, it’s really a gift. Easy to download and install takes just 5 min. it’s obsultely realtime with google. Last time i tried ninja and downloaded takes long time to instal. After that i check with trading hours it’s time delay of 15min.

Now we shall explain wave cycle using the below mentioned image. To mark the inner waves any variation of the above mentioned letter of character may be used. For example if we mark a wave then inner 5 waves may be marked as ,,,, or may be marked by any other variation as per choice of the analyst.

Flat:

Within motive waves, wave 2 never retraces more than 100% of wave 1, and wave 4 never retraces more than 100% of wave 3. Wave 3, moreover, always travels beyond the end of wave 1. The goal of a motive wave is to make progress, and these rules of formation assure that it will. Each the Motive waves are in the direction of the trend, and the declining Corrective waves (2 & 4) are smaller than the motive waves and go against the prevailing trend. If you see this pattern play out in full, it serves to reinforce the idea that we’re moving in a trend and points to the direction of the trend. While providing the Elliott Wave Theory definition, Elliot maintained that the theory does not provide any certainty while predicting future price movements.

- Due to investors’ psychology or sentiments, the stock market patterns are repetitive up and down.

- Corrective waves are more complex and time-consuming than motive waves.

- Ichimoku trading system even 5-13 EMA channel trading system and also still need to explore a lot in this software package.

Also, sub-wave 3 of the diagonal is not the shortest wave. The three main types of corrective waves are Zig-Zag, Diagonal and Triangle Waves. Investors can get an insight into ongoing trend dynamics when observing these waves and also helps in deeply analyzing the price movements. The A and C waves are both considered to be motive waves, while the B wave is considered to be corrective (often with 3 sub-waves). Each sub-wave of the diagonal wave, much like the sub-waves of other motive waves, does not entirely retrace the path taken by the preceding sub-wave. In addition, the third subwave of the diagonal is not the wave with the shortest length.

Corrective Waves (waves 2 and 4; B) with tends to be messy and choppy. Motive Waves (waves 1,3 and 5; A and C) which tend to be smooth and firm. The remaining two Elliott Waves, the second and fourth, act as minor retracement points or counter-trends within the underlying trend.

Catching Up to a Great Film That I Waited Decades to See – The New Yorker

Catching Up to a Great Film That I Waited Decades to See.

Posted: Fri, 05 May 2023 23:23:59 GMT [source]

Moreover, it also has three different rules that help to define the formation. In case any of these rules get violated, the structure will not be considered as the impulse wave, and you’d have to re-label it from the beginning. The best time frame for Elliott Waves would depend on your comfort zone and trading style.

Russia and Ukraine fight to control narrative, territory as war enters … – Axios

Russia and Ukraine fight to control narrative, territory as war enters ….

Posted: Fri, 05 May 2023 03:29:39 GMT [source]

At the core of this principle, Elliott noted thirteen distinct market patterns or waves that periodically repeat in both shape and form. Technical analysis is the study of chart patterns, graphs and diagrams on a screen. The idea is to understand price and volume trends and pick stocks accordingly. Technical analysis believes that whether you talk about fundamentals, news flows, or earnings surprises, they are all in trice and volume. The 3 waves towards reverse direction of main trend are called corrective wave/Correction.

However, It was found that a motive wave might consist of three waves rather than five in real-time markets. In reality, the market will often experience a motive wave made up of three waves. The market might possibly continue to move in corrective waves. Three-wave trends are therefore more typical than five-wave trends. A useful strategy for trading using the Elliot Wave Patterns is called Channeling. Draw a I-III channel line connecting the peaks of wave I and III, to identify the bottom of the IV wave by extending that line from the II wave.

Last coupe of weeks we spend our energy in understanding the quality of the datafeeds(Indian & International vendors) for NSE Futures. This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. Figures 2, 3 and 4 all depict impulses in the 1, 3, 5, A and C wave positions. The head and shoulders bottom is sometimes referred to as an inverse head and shoulders. We start with the price distance of each wave.To be able to able to apply successfully Fibonacci Extension calculation we need to review t…

At any given period the price movements seem to alternate between an impulsive wave or motive wave and a corrective wave. There are two main types of waves- motive waves and corrective waves. WD Gann’s Price & Time AnalysisMajor Time PeriodsWhat WD Gann Wrote about Time Periods? Elliott Wave Theory is a simple yet effective technique to gain valuable insights into trend dynamics and understand comprehensive price movements. Knowing how and when the market will repeat itself makes it easier for investors to make informed investment decisions.